Heloc borrowing calculator

Please consider one of the borrowing options below. Start with our refinance calculator to estimate your rate and payments.

Heloc Calculator To Calculate Maximum Home Equity Line Of Credit

Using our loan amount calculator can allow you to enter your home value remaining mortgage balance and credit score to see how much your equity and credit allow you to borrow.

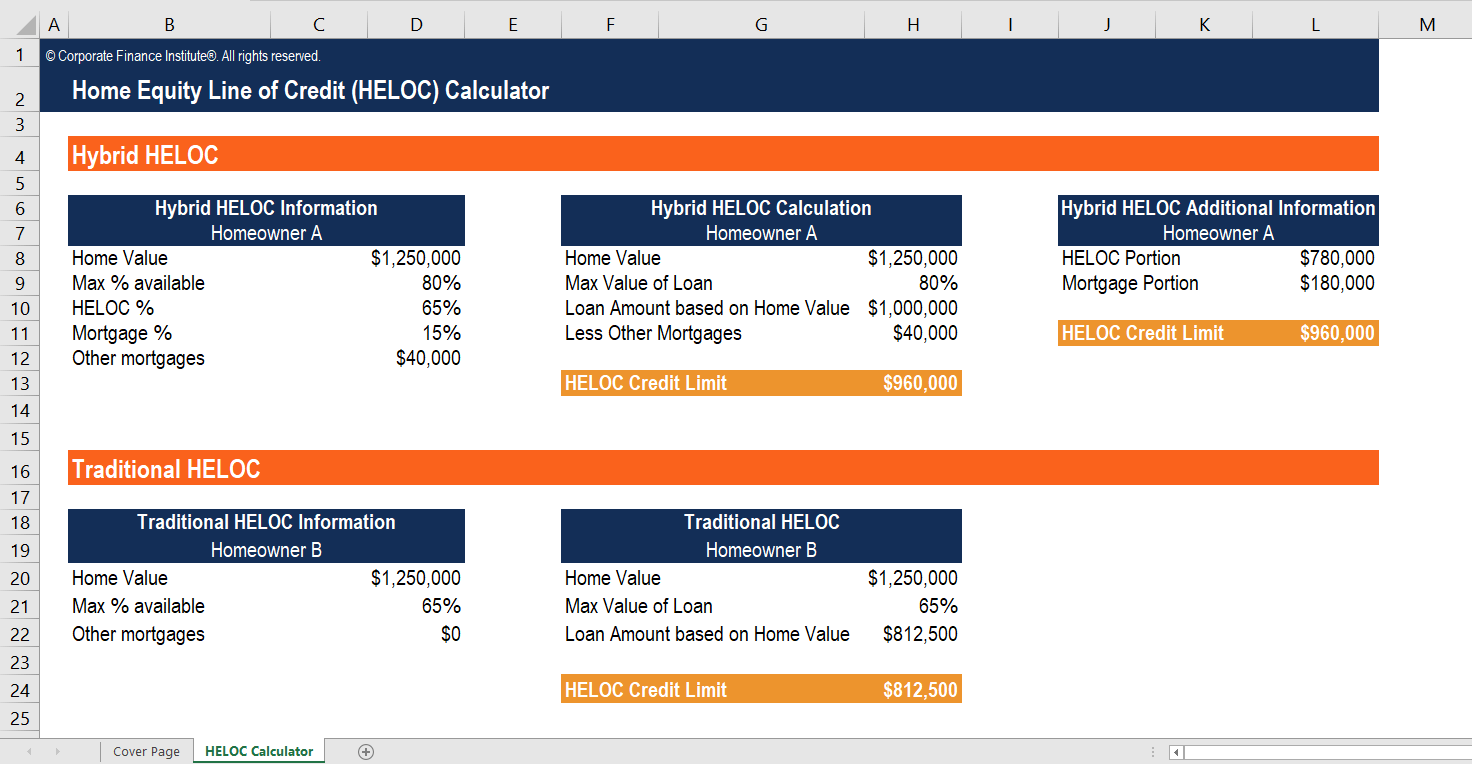

. In large part because you are only borrowing a limited fraction of the homes value. CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value. If your home is worth 100000 and you owe 40000 on your mortgage then your CLTV is 40.

HELOCs act more like credit cards. Additionally we provide a simple way to see how much your monthly payments would be for a home equity loan from Discover with breakdowns for the different term. What is the difference between getting a HELOC and a second mortgage.

Home Equity Loan Calculator Reduce Your Monthly Debt Payments. You are underwater on your mortgage Your credit score has dropped below 620. Your income is too low to make the monthly payments on a new loan.

Cash-out refinance Refinancing your mortgage can allow you to access available equity by taking cash out. As you decide between a HELOC and a home equity loan consider the pros and cons of both types of borrowing. To figure out how much your credit limit would be on this HELOC multiply your homes value by 80 and subtract your current balance.

Going off our earlier example lets say you find a lender whos willing to give you a HELOC with 80 LTV. Heres how the average interest rate breaks down based on the loan-to-value ratio. Home Equity Line of Credit HELOC.

Fixed interest rate and fixed payments. A home equity loan gives you all the money at once with a fixed interest rate. Banks see a HELOC with a loan-to-value ratio over 80 as a bigger risk.

Loan modification may be your only option if. 250000 X 80 200000. Generally banks charge more for those loans.

A HELOC on the other hand gives you the flexibility to borrow and pay off the credit whenever you want. You can borrow what you need as you need it up to a certain limit. Home equity loan pros.

When you have a HELOC you may be charged a small nominal annual fee - say 50 to 100 - to keep the line open but you do not accrue interest until you draw on the line. For example say your home is worth 350000 your mortgage balance is 200000 and your lender will allow you to borrow up to 85 of your homes value. While both a HELOC and a second mortgage use your home equity as collateral a second mortgage can offer you access to a higher total borrowing limit at a higher interest.

Your home is worth 250000 and you currently owe 180000. When you get a HELOC through Prosper your mortgage and HELOC combined can be worth as much as 90 of your homes fair market value.

Home Equity Loan Vs Personal Loan Which Is Better For You Home Equity Loan Personal Loans Home Equity

How To Calculate Equity In Your Home Nextadvisor With Time

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Calculator Overview

Pin On Loan

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips

Home Equity Line Of Credit Qualification Calculator

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

Heloc Calculator Calculate Available Home Equity Wowa Ca

How Much Interest Will I Pay Credit Card Payment How To Calculate Credit Card Payment Creditcard Creditcardpayment Calculation H Heloc Mortgage Debt

Heloc Calculator How Much Could You Borrow The Motley Fool The Borrowers Heloc

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

Heloc Calculator Loan Calculators Credit Union West Arizona

Home Equity Calculator Free Home Equity Loan Calculator For Excel

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Heloc Calculator

Looking For A Heloc Calculator