Compound interest calculator with deductions

Online Compound Interest Calculator - Use ClearTax compound interest calculator to calculate compound interest earned daily weekly monthly quarterly annually. With the use of our Dividend Tax Calculator you are able to discover how much income tax you will be paying with the input of your current salary and the annual dividend payments that you make.

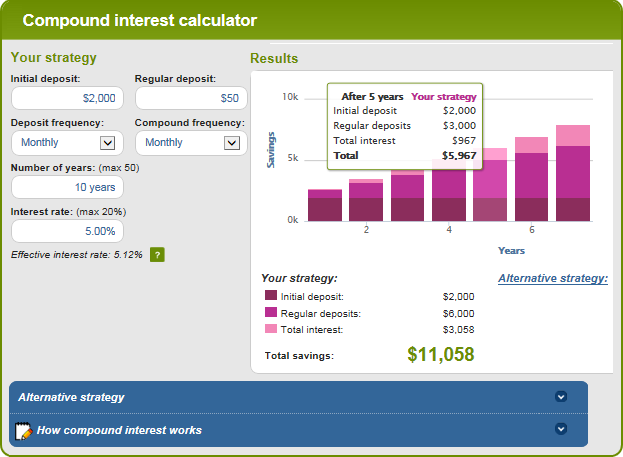

Compound Interest Calculator Daily Monthly Quarterly Annual

If you make 70000 a year living in the region of Virginia USA you will be taxed 12100.

. For married taxpayers filing separate returns the cap is 375000. For example the amount of compound interest that accrues on Rs 10000 compounded at 8 annually for five years will be lower as compared to Rs 10000 compounded quarterly at the same rate of interest over the same period. But mortgage interest is not the same as other types of debt.

You cant write off the loan but you may be able to deduct interest paid. Mr X has 3 house property 2 are self-occupied 1 of them is offered for rent. For example if a sum of Rs 10000 is invested for 3 years at 10 compound interest rate quarterly compounding then at the time of maturity A.

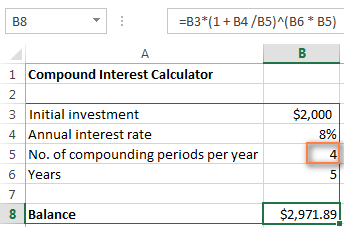

Claim your deductions and get your acknowledgment number online. A P 1rn n t Where A Maturity Amount. This calculator has been updated for the 2022-23 tax year.

Pa before tax and super max. Your average tax rate is 1198 and your marginal tax rate is 22. Interest paid on a home loan of both the self-occupied properties is Rs 300 lakhs and interest paid on rent out a property is Rs.

You can efile income tax return on your income from salary house property capital gains business profession. Your average tax rate is 1198 and your marginal tax rate is 22. A PMT 1rnnt 1 rn A Future Value of the Investment PMT Payment amount for each period n number of compounds in a period t number of periods the money is invested For example you have an.

Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. 1000000 Desired retirement age. Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future.

The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States. These are the deductions that will not be withheld by the employer but can be subtracted from taxable income including IRA contributions student loan interest qualified tuition and education-related fees up to 4000 etc. Under section 80C of the Income Tax Act investors can claim deduction up to INR 150000.

If you make 70000 a year living in the region of Ohio USA you will be taxed 10957. The limit for this deduction is Rs50000. You must use the mathematical formula.

25 If you are self employed enter in 0 for employer contribution and enter all your contributions as voluntary. 4 min read Nov 05 2021 Standard deduction amount for 2020-2021. T number of years.

Take State Income Tax Deductions. To use the calculator for the previous rates please click here. Marriage has significant financial implications for the individuals involved including its impact on taxation.

P Principal amount. Section 80 TTB Interest Income Deduction of Interest on Deposits for Senior Citizens. What all deductions can be claimed by him under house property.

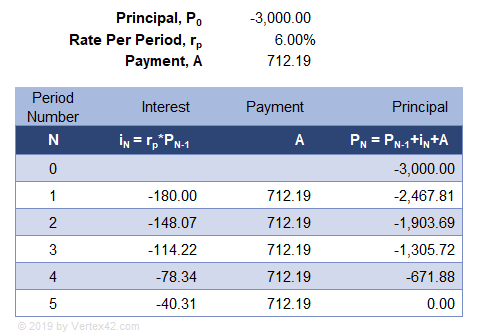

The SWP Calculator shows you the regular cash flows through the systematic withdrawal plan. Formula for Compound Interest. This marginal tax rate means that your.

To use our calculator simply. This calculator uses the new IRD rates post March 31st 2021 and does include the new 39 personal tax rate on remaining income over 180000. Free calculators for your every need.

Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. This lets us find the most appropriate writer for any type of assignment. R Rate of Interest in decimals n number of compounding in a year.

Example of claiming deductions under the following scenario. Saving money on interest is not the worst idea in the world. Both PPF and FD investments can be claimed for tax deductions.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The ClearTax Simple Interest Calculator shows you the compound interest that you earn on investments. However when you calculate compound interest the period of compounding makes a significant difference.

Pay As You Earn PAYE is a withholding income tax for employees in. You can efile income tax return on your income from salary house. Its tax-deductible if you itemize.

Simple Interest Calculator - Use ClearTax simple interest calculator to calculate simple interest. An online PPF interest calculator provides an investor with an estimation of how much interest can be earned given an amount of principal in hand. A new section 80TTB has been inserted vide Budget 2018 in which deductions with respect to interest income from deposits held by senior citizens will be allowed.

How much it is and when to take it. Does PPF compound interest annually. Other Mortgage Considerations.

However you may only. Claim your deductions and get your acknowledgment number online. This marginal tax rate means that.

You will have to do some research to determine the amounts of these deductions and how to send them to the appropriate statelocal taxing authority. Then make adjustments to your employer W-4 form if necessary to more closely match your 2022 federal tax liability. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances claimed.

How does SWP Calculators work. 75 This calculator is limited to a retirement age of 75Income. The interest you pay for your mortgage can be deducted and is limited to interest on 750000 of your mortgage or less 375000 for married filing separate taxpayers of mortgage debt incurred.

Most states impose income taxes on employee salaries and wages.

37 Handy Business Budget Templates Excel Google Sheets ᐅ Inside Small Business Bud Excel Budget Template Business Budget Template Budget Template Excel Free

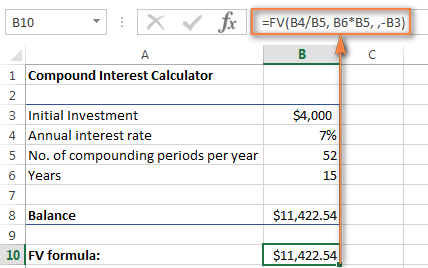

Compound Interest Formula And Calculator For Excel

Pin On Enquirygate

Pin On Excel Tips

Compound Interest Calculator For Excel

Paypal Fees Calculator Know How Much You Ll Pay My Money Cottage Paypal Online Calculator Money Saving Advice

Compound Interest Calculator For Excel

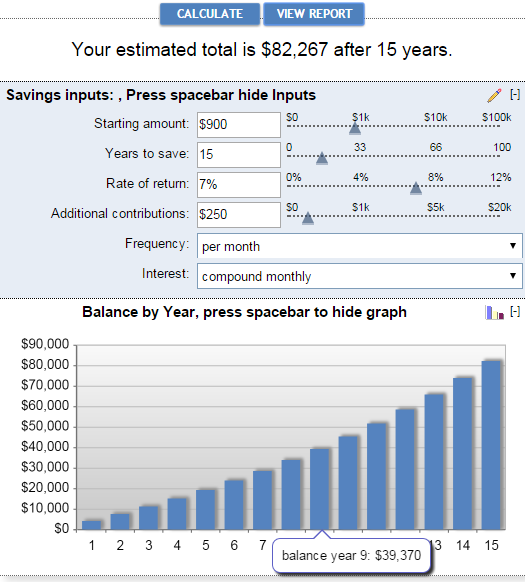

Compound Interest Calculator Daily Monthly Quarterly Annual

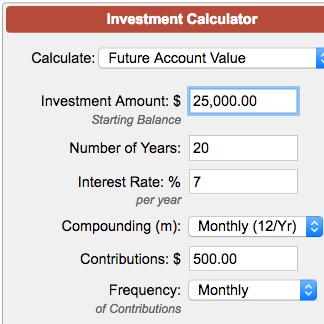

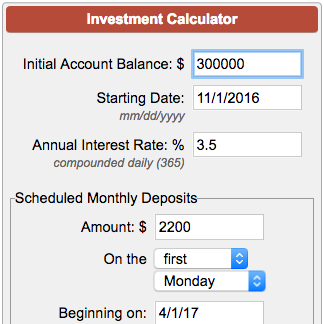

Investment Calculator

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator Investor Gov Interest Calculator Compound Interest Calculator

What Is Tax Deducted At Source Tds Threshold Limit Tds Return Tds Refund Exceldatapro Tax Deducted At Source Payroll Tax Exemption

Pin On Accounting Blog

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator Daily Monthly Quarterly Annual

Investment Account Calculator

Compound Interest Formula And Calculator For Excel